The last 30 to 40 years cover a time when Americans have seen their social safety net disappear as government policy decisions have shifted more and more risk to the individual. This burden of risk was not inevitable. It is the result of a deliberate and systematic effort by both political parties (though Republicans deserve far more credit) to reverse and defund programs that help individuals and their families weather the storms of modern life. It’s especially visible to all of us now as our society struggles through the COVID 19 pandemic.

As more risks have been shifted to the individual, stagnant wages for 90 percent of Americans means less and less of each paycheck is available to mitigate those risks.

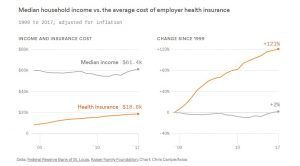

Health insurance costs for workers eat up almost one-third of income

After adjusting for inflation, the median household income has only increased by 2% from 1999 to 2017, whereas employer health insurance costs have increased by some 121% over this same period. As of 2017, health insurance costs were estimated to represent about 30% of the average household income.

Health insurance has hovered consistently around 31% of household income since 2012, as companies shifted their employees to plans that had steady premiums but higher deductibles and out-of-pocket costs.

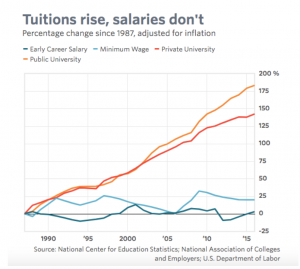

College costs for families have soared

In the late 1980s, public colleges typically got about one-quarter of their revenue from tuition, now that’s up to about 50%, according to Michael Mitchell, a senior policy analyst at the Center on Budget and Policy Priorities.

“If you were to go back 30 to 40 years, public funding for higher education was substantial enough that for many students, higher education was very affordable,” Mitchell said. “There has been a shift in how we think about public higher education, not so much as a social good, but as the benefit for the individual. As you make that shift there’s also the idea that the individual is responsible for paying for it.”

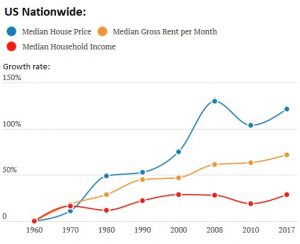

Housing costs continue to grow much faster than income

Just how large the discrepancy between income versus rents and house prices has become over the years is depicted in a new study with long-term charts, released by the research department of Clever Real Estate. Based on Census data going back to 1960 for median household incomes, median gross rents per month, and median house prices, all adjusted for inflation, it shows that nationally, incomes since 1960 have risen just 29%, while rents have risen 72%, and house prices have soared 121%:

Unemployment insurance benefits have steadily declined

While these charts illustrate the “living paycheck to paycheck” state of most Americans today, the COVID19 pandemic has pushed even more to the financial brink with 40+ million filing for unemployment in the second quarter of 2020. Here too, the risk from the loss of job has been pushed off more and more on the individual.

For the past 30 years, state governments have raised eligibility requirements and reduced benefits for unemployment insurance, according to the Washington Spectator. During 2019, fewer than one-third of the unemployed qualified for benefits, and benefits replaced only one-third of previous wages.

So, for the basics of life in a thriving democracy—housing, healthcare, education and job security—nearly all Americans are simply on their own. Their government and their employers have convinced them that it’s their individual responsibility to take care of themselves. They are told to save when there’s no money left over at the end of the month. They are expected to work harder for minimal wages when they are exhausted from working two and sometimes three jobs to feed their families and make ends meet.

Who is responsible? Who is to blame?

It is the COVID19 that has shattered the illusion that America had been experiencing a prosperous economy before the pandemic hit. Yet, even in these dire times, when through no fault of their own millions of Americans have lost jobs (and their associated health insurance coverage), many still feel it’s their fault as individuals.

Here is a telling observation from a recent survey conducted last year:

“…we asked respondents to name the greatest challenges facing their families. Respondents were unanimous in naming affordable healthcare, affordable housing, and affordable education for their children as their greatest challenges. There was less consensus, however, around who is responsible for addressing these needs. Even as the majority of respondents claimed it is the individual’s responsibility to provide and care for their family members, many found it impossible to do so without making serious compromises to their values, and named government programs as the solution.

To summarize, while many of the people we have surveyed – Millennials, gig workers, parents – feel financially strapped and are drawn to the idea of receiving more support from their communities and the government, they are reluctant to ask for help or even admit that they need help, and tend to see doing so as an individual failure.”

The social safety net isn’t an entitlement. It’s the foundation of our freedom.

Forged in the wake of the Great Depression and expanded in the 1960s and 1970s, government programs such as Social Security, Medicare, food stamps, Medicaid, housing subsidies, and more are now labeled “entitlements.” The word entitlement has a negative connotation. One that suggests it’s something not earned and therefore not deserved. In fact, social security is “social Insurance” that every wage earner pays for. The same is true of Medicare.

The genuine entitlements in our society today are an ever growing “defense” budget that is 20 times larger than any other country in the world and is accountable to no one. And the corporate tax system that allows companies with billions in profits to pay no taxes at all.

It’s obvious that attitudes about individual responsibility are deeply embedded in the American psyche. But perhaps a catastrophe as universal as the COVID19 pandemic will help more Americans realize these so-called entitlements are the very foundation of our freedom in a democracy: freedom from want, and freedom from fear. Without the social safety net, we are entirely vulnerable and alone, unable to provide for ourselves and our families. Yes, the government needs to provide basic support for a decent living but we also have to take responsibility for making it work for us. The day of reckoning is here.